flying cars global huge mega projects...

- Get link

- X

- Other Apps

01

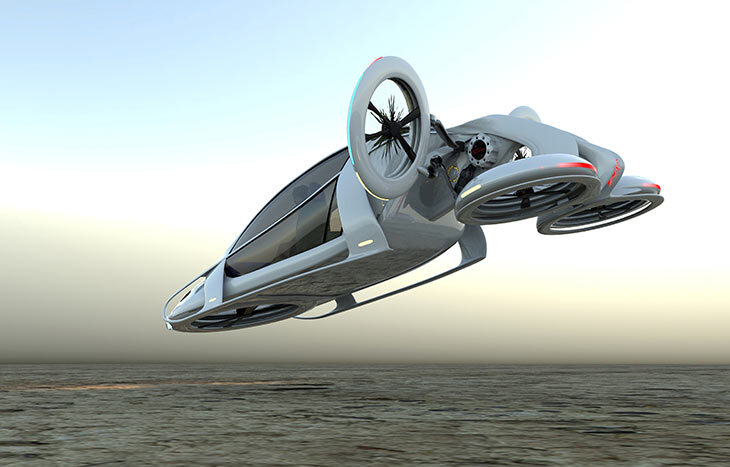

Flying car

GeekWire Daily - Top headlines daily

GeekWire Weekly - Most-read stories of the week, delivered Sunday

Breaking News Alerts - Important news as it happens

GeekWire Startups - News, analysis, insights from the Pacific Northwest startup ecosystem, delivered Friday

GeekWire Mid-week Update — Most-read stories so far this week, delivered Wednesday

GeekWire Local Deals — Special offers for Pacific Northwest area readers

Flying Car Stocks That Are Cleared For Takeoff

In 1989, Marty McFly hopped in his flying DeLorean so he could travel to the future and fix his family. In the movie, Marty travels to the year 2015. Well, it’s now 2022 and you still can’t buy a flying car at the local car lot. However, that doesn’t mean that flying car stocks aren’t being developed.

Right now, there are several companies that are working to make flying cars a reality. In addition to being an awesome tech development, flying cars will also solve a major societal issue. That issue is the intense gridlock that is starting to stifle many metropolitan areas. In particular, Boston commuters spent almost 6 full days in traffic in 2019. Other cities with major congestion are Chicago, Philadelphia and Los Angeles. Any company that offers commuters an alternative to sitting in traffic will surely have lots of eager customers.

Since hating traffic is universal, the flying car market has the potential to be huge. Due to this, investors are eagerly looking for potential flying car stocks to buy. However, since the industry doesn’t technically exist yet, it’s a little tough to find any publicly-traded flying car stocks. To help, I’ve found a few companies that are leading the way.

Keep in mind that most of these companies are technically “electric vertical takeoff and landing (eVTOL) aircraft. Instead of a car with wings, think of a slightly smaller personalized helicopter.

With that said, let’s look at a few of the best flying car stocks to buy.

As Joby Aviation recently went public, this might be the first that you’re hearing about this flying car stock. However, that doesn’t mean its team hasn’t been working hard for years. Joby was launched in 2009 and released its first prototype in 2015. More recently, it purchased Uber’s flying car division. Joby expects to start commercial operations as soon as 2024.

Joby’s helicopter has a vertical takeoff, can seat 4 passengers (plus the pilot) and reaches a top speed of 200 mph. This makes it perfect for congested metropolitan areas like Los Angeles. Joby’s helicopters would be able to turn an hour-long drive into a 15-minute flight. The phrase that Joby uses to describe its business is “electric aerial ridesharing.”

In the second half of 2021, Joby went public through a merger with SPAC Reinvent Technology Partnerships. It has only released data from FY 2021 where it reported a net loss of $180 million. However, this loss is expected since commercial flights aren’t starting until 2024.

Other than that, Joby is in the process of receiving its Part 135 Air Carrier Certificate. This certificate is required before starting revenue-generating passenger flights. For risk-averse investors, you might want to wait until after this certificate has been secured. For opportunistic investors, you can get into this flying car stock at a potential buy before it gets this certificate.

Joby’s stock has remained steady at approximately $5/share in the recent months.

Archer Aviation (NYSE: ACHR)Archer Aviation is another flying car stock that recently went public via SPAC. In late 2021, it merged with Atlas Crest Investment Corporation. According to Archer Aviation’s website, it is “powering the future of urban air mobility.” Archer offers a similar style of flying car to Joby (eVTOL).

Notably, Archer has secured a partnership with United Airlines. This is actually a significant competitive advantage. United will be there over the coming years to offer capital and expertise. Additionally, Untied could potentially become a very large customer for Archer.

Archer plans to unveil the first generation of its aircraft in 2023. It is considering Los Angeles and Miami as its flagship cities. This flying car company posted a net loss of around $72 million in Q2 2022.

Archer’s stock has dropped by about 50% year-to-date. However, it’s so early on for this flying car stock that I wouldn’t worry much about its movements.

EHang (Nasdaq: EH)The final flying car stock is in China. EHang offers eclectic passenger-grade autonomous aerial vehicles. Out of all three of these companies, Ehang has the most public financial information available.

In 2021, EHang posted $57 million in annual revenue. This represented a 68% decrease from 2020. However, it also reported a total net loss of $314 million in 2021. Just like with the previous flying stocks, I wouldn’t focus too much on these early initial losses.

Ehang’s stock is down 64% over the past year.

Those are the three major flying car stocks that appear to be closest to bringing a product to market. However, there are a few other flying car companies worth mentioning.

Honorable MentionsJust like with self-driving cars, many companies are quick to jump on the bandwagon. Every company wants to act as if it’s on the cutting edge of the industry. However, many of these flying car stocks are vague on how close they are on delivering on its promises.

For me, it’s a little tough to get excited before actual prototypes are delivered. With that said, here are a few other companies that could potentially become flying car stocks. These companies have mainly just released very initial concepts of what its car would look like:

I hope that you’ve found this article valuable when it comes to learning a few potential flying car stocks to buy. As usual, all investment decisions should be based on your own due diligence and risk tolerance.

Why Flying Car Stocks Fell in August

What happenedFew emerging industries seem more inspired by science fiction than battery-powered personal aircraft. So perhaps it is no surprise that in a market where investors are fleeing from pre-revenue, speculative investments, so-called "flying car" stocks have taken it on the chin.

In August, shares of Vertical Aerospace (EVTL -2.90%) fell 30%, shares of Lilium (LILM 7.55%) lost 19%, and Archer Aviation (ACHR -2.25%) sank by 12%, according to data provided by S&P Global Market Intelligence, as investors kept their focus on safer, more reliable investments.

Vertical, Lilium, and Archer are all developing eVTOLs -- electric airplanes capable of vertical takeoffs and landings. Those three companies, along with peer Joby Aviation (JOBY -4.83%), all joined the public market over the past year via mergers with special-purpose acquisition companies (SPACs) to raise funds to bring their aircraft designs to market.

Certainly eVTOLs won't replace the large jets made by Boeing and Airbus anytime soon, but they could play an intriguing role in our transportation future. These small planes are designed to ferry four to six people on short trips, either bypassing traffic in crowded cities or bringing passengers from outer suburbs and small cities to large, metropolitan airports.

Both Archer and Vertical released their second-quarter results during August, but there was little in those reports to justify their dramatic share price declines. Neither company has much to report in terms of financial results for now, but both said they are making progress in bringing their products to market. Archer did say United Airlines Holdings had paid a $10 million deposit on 100 aircraft that it ordered last year, which would seem to be a positive development.

Alas, investors in August didn't have a lot of appetite for shares of companies that have little to offer beyond great expectations for the future. With the Federal Reserve hiking interest rates to fight high inflation, investors are trying to figure out whether the U.S. and global economies are headed for a recession. A so-called "risk off" climate prevails on Wall Street, and pre-revenue aerospace companies aren't the type of stocks that investors tend to rush into when they are trying to reduce the risk in their portfolios.

Indeed, for all the progress these companies have shown, none of them is certain to reach their destination. Given that eVTOLs are a new category of aircraft, they will likely face significant scrutiny from the Federal Aviation Administration and foreign regulators, which could delay their rollouts and could necessitate additional R&D spending beyond what the manufacturers expect.

And even if the eVTOL market develops as the optimists hope, there are a lot of different companies and different designs chasing an uncertain amount of business. It seems likely that things won't go to plan for all the companies chasing this opportunity, creating an additional layer of risk to buying individual stocks in this space.

Now whatIt is fair to say that these are potentially disruptive companies attempting to create an exciting new market. It's also fair to call them highly speculative investments. Even in the best-case scenario, we are likely to see significant turbulence in their share prices from here as these companies not only go through the typical growing pains that pre-revenue companies face, but also endure the vagaries of macroeconomic factors that are beyond their control.

For investors who find the promise of eVTOLS compelling, keep your seat belt fastened and limit stocks like Archer, Vertical, and Lilium to a small part of a well-diversified portfolio.

Lou Whiteman has positions in Joby Aviation, Inc. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Good day...

Comments

Post a Comment

If you have any doubt, please let me know....