E BOOKS ON AMAZON GLOBAL MARKETPLACE....

E-books Market Size In 2023 : High Demand, Share, Top Countries Data, Industry Analysis by Top Players, and Forecasts to 2029

The MarketWatch News Department was not involved in the creation of this content.

Jan 12, 2023 (The Expresswire) -- Final Report will add the analysis of the impact of Russia-Ukraine War and COVID-19 on this industry.

A recent research report published by Precision Reports provides an overview of the "E-books Market" along with precise insights into potential future scenarios. The report suggests that this industry is expected to experience an annual revenue increase (in USD Mn) During the Forecast Period.

E-books Market Size is projected to Reach Multimillion USD by 2029, In comparison to 2021, at unexpected CAGR during the forecast Period 2022-2029.

Browse Detailed TOC, Tables and Figures with Charts which is spread

across Many Pages that provides exclusive data, information, vital

statistics, trends, and competitive landscape details in this niche

sector. amazon.com

TO KNOW HOW COVID-19 PANDEMIC AND RUSSIA UKRAINE WAR WILL IMPACT THIS MARKET - REQUEST SAMPLE amazon.com

This research report is the result of an extensive primary and secondary research effort into the E-books market. It provides a thorough overview of the market's current and future objectives, along with a competitive analysis of the industry, broken down by application, type and regional trends. It also provides a dashboard overview of the past and present performance of leading companies. A variety of methodologies and analyses are used in the research to ensure accurate and comprehensive information about the E-books Market.

Get a Sample PDF of report -https://www.precisionreports.co/enquiry/request-sample/16503897

E-books Market - Competitive Analysis: amazon.com

Who are the Leading Key Players Operating In this Market?

● Amazon● Georg Von Holtzbrinck● Hachette Livre● HarperCollins Publishers● McGraw-Hill Education● Pearson● Penguin Random House● Rakuten Kobo● Simon and Schuster

Attractive Opportunities In the E-books Market: amazon.com

The Global E-books market is anticipated to rise at a considerable rate during the forecast period, between 2023 and 2029. In 2021, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

The United States E-books market is expected at value of USD million in 2023 and grow at approximately % CAGR during review period. China constitutes a % market for the global E-books market, reaching USD million by the year 2029. As for the Europe E-books landscape, Germany is projected to reach USD million by 2029 trailing a CAGR of % over the forecast period. In APAC, the growth rates of other notable markets (Japan and South Korea) are projected to be at % and % respectively for the next 5-year period. amazon.com

North America, especially The United States, will still play an important role which cannot be ignored. Any changes from United States might affect the development trend of E-books. The market in North America is expected to grow considerably during the forecast period. The high adoption of advanced technology and the presence of large players in this region are likely to create ample growth opportunities for the market.

Europe also play important roles in global market, with a magnificent growth in CAGR During the Forecast period 2023-2029.

E-books Market size is projected to reach Multimillion USD by 2029, In comparison to 2023, at unexpected CAGR during 2023-2029.

Despite the presence of intense competition, due to the global recovery trend is clear, investors are still optimistic about this area, and it will still be more new investments entering the field in the future.

Global main E-books players cover Amazon, Georg Von Holtzbrinck, Hachette Livre, HarperCollins Publishers, McGraw-Hill Education, Pearson, Penguin Random House, Rakuten Kobo, Simon and Schuster, etc. In terms of revenue, the global largest two companies occupy a share nearly % in 2022.

This report presents a comprehensive overview, market shares, and growth opportunities of E-books market by product type, application, key players and key regions and countries.

Get a Sample Copy of the E-books Report 2022 amazon.com

E-books Market - Segmentation Analysis:

Which segment is expected to lead the global E-books market during the forecast period?

Based on Type, the market can be classified intoFiction e-books, Non-fiction and education e-books, Others amazon.com

What are the key driving factors for the growth of the E-books Market?

Use of Kindle, Phone, Other Devices and in multiple sectors has led to significant growth in demand for E-books in the market

Which region is dominating the E-books market growth? amazon.com

Region Wise the global trend is analyzed across : amazon.com

● North America (United States, Canada and Mexico) ● Europe (Germany, UK, France, Italy, Russia and Turkey etc.) ● Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia and Vietnam) ● South America (Brazil, Argentina, Columbia etc.) ● Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)This E-books Market Research/Analysis Report Contains Answers to your following Questions

● What are the global trends in the E-books market? Would the market witness an increase or decline in the demand in the coming years? ● What is the estimated demand for different types of products in E-books? What are the upcoming industry applications and trends for E-books market? ● What Are Projections of Global E-books Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about Import and Export? ● Where will the strategic developments take the industry in the mid to long-term? ● What are the factors contributing to the final price of E-books? What are the raw materials used for E-books manufacturing? ● How big is the opportunity for the E-books market? How will the increasing adoption of E-books for mining impact the growth rate of the overall market? ● How much is the global E-books market worth? What was the value of the market In 2020? ● Who are the major players operating in the E-books market? Which companies are the front runners? ● Which are the recent industry trends that can be implemented to generate additional revenue streams? ● What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for E-books Industry?Customization of the Report amazon.com

Our research analysts will help you to get customized details for your report, which can be modified in terms of a specific region, application or any statistical details. In addition, we are always willing to comply with the study, which triangulated with your own data to make the market research more comprehensive in your perspective.

Inquire more and share questions if any before the purchase on this report at -https://www.precisionreports.co/enquiry/pre-order-enquiry/16503897

Detailed TOC of Global E-books Market Insights and Forecast to 2029 amazon.com

1 E-books Market Overview1.1 Product Overview and Scope of E-books1.2 E-books Segment by Type1.2.1 Global E-books Market Size Growth Rate Analysis by Type 2022 VS 20291.3 E-books Segment by Application1.3.1 Global E-books Consumption Comparison by Application: 2022 VS 20291.4 Global Market Growth Prospects1.4.1 Global E-books Revenue Estimates and Forecasts (2017-2029)1.4.2 Global E-books Production Estimates and Forecasts (2017-2029)1.5 Global Market Size by Region1.5.1 Global E-books Market Size Estimates and Forecasts by Region: 2017 VS 2021 VS 20291.5.2 North America E-books Estimates and Forecasts (2017-2029)1.5.3 Europe E-books Estimates and Forecasts (2017-2029)1.5.4 China E-books Estimates and Forecasts (2017-2029)1.5.5 Japan E-books Estimates and Forecasts (2017-2029)1.5.6 South Korea E-books Estimates and Forecasts (2017-2029) amazon.com

2 Market Competition by Manufacturers2.1 Global E-books Production Market Share by Manufacturers (2017-2022)2.2 Global E-books Revenue Market Share by Manufacturers (2017-2022)2.3 E-books Market Share by Company Type (Tier 1, Tier 2 and Tier 3)2.4 Global E-books Average Price by Manufacturers (2017-2022)2.5 Manufacturers E-books Production Sites, Area Served, Product Types2.6 E-books Market Competitive Situation and Trends2.6.1 E-books Market Concentration Rate2.6.2 Global 5 and 10 Largest E-books Players Market Share by Revenue2.6.3 Mergers and Acquisitions, Expansion

3 Production by Region3.1 Global Production of E-books Market Share by Region (2017-2022)3.2 Global E-books Revenue Market Share by Region (2017-2022)3.3 Global E-books Production, Revenue, Price and Gross Margin (2017-2022)3.4 North America E-books Production3.4.1 North America E-books Production Growth Rate (2017-2022)3.4.2 North America E-books Production, Revenue, Price and Gross Margin (2017-2022)3.5 Europe E-books Production3.5.1 Europe E-books Production Growth Rate (2017-2022)3.5.2 Europe E-books Production, Revenue, Price and Gross Margin (2017-2022)3.6 China E-books Production3.6.1 China E-books Production Growth Rate (2017-2022)3.6.2 China E-books Production, Revenue, Price and Gross Margin (2017-2022)3.7 Japan E-books Production3.7.1 Japan E-books Production Growth Rate (2017-2022)3.7.2 Japan E-books Production, Revenue, Price and Gross Margin (2017-2022)3.8 South Korea E-books Production3.8.1 South Korea E-books Production Growth Rate (2017-2022)3.8.2 South Korea E-books Production, Revenue, Price and Gross Margin (2017-2022) amazon.com

4 Global E-books Consumption by Region4.1 Global E-books Consumption by Region4.1.1 Global E-books Consumption by Region4.1.2 Global E-books Consumption Market Share by Region4.2 North America4.2.1 North America E-books Consumption by Country4.2.2 United States4.2.3 Canada4.3 Europe4.3.1 Europe E-books Consumption by Country4.3.2 Germany4.3.3 France4.3.4 U.K.4.3.5 Italy4.3.6 Russia4.4 Asia Pacific4.4.1 Asia Pacific E-books Consumption by Region4.4.2 China4.4.3 Japan4.4.4 South Korea4.4.5 China Taiwan4.4.6 Southeast Asia4.4.7 India4.4.8 Australia4.5 Latin America4.5.1 Latin America E-books Consumption by Country4.5.2 Mexico4.5.3 Brazil

5 Segment by Type5.1 Global E-books Production Market Share by Type (2017-2022)5.2 Global E-books Revenue Market Share by Type (2017-2022)5.3 Global E-books Price by Type (2017-2022)

6 Segment by Application6.1 Global E-books Production Market Share by Application (2017-2022)6.2 Global E-books Revenue Market Share by Application (2017-2022)6.3 Global E-books Price by Application (2017-2022) amazon.com

7 Key Companies Profiled7.1 Company 17.1.1 Company 1 E-books Corporation Information7.1.2 Company 1 E-books Product Portfolio7.1.3 Company 1 E-books Production, Revenue, Price and Gross Margin (2017-2022)7.1.4 Company 1 Main Business and Markets Served7.1.5 Company 1 Recent Developments/Updates

Continued.. amazon.com

8 E-books Manufacturing Cost Analysis8.1 E-books Key Raw Materials Analysis8.1.1 Key Raw Materials8.1.2 Key Suppliers of Raw Materials8.2 Proportion of Manufacturing Cost Structure8.3 Manufacturing Process Analysis of E-books8.4 E-books Industrial Chain Analysis

9 Marketing Channel, Distributors and Customers9.1 Marketing Channel9.2 E-books Distributors List9.3 E-books Customers

10 Market Dynamics10.1 E-books Industry Trends10.2 E-books Market Drivers10.3 E-books Market Challenges10.4 E-books Market Restraints

11 Production and Supply Forecast11.1 Global Forecasted Production of E-books by Region (2023-2029)11.2 North America E-books Production, Revenue Forecast (2023-2029)11.3 Europe E-books Production, Revenue Forecast (2023-2029)11.4 China E-books Production, Revenue Forecast (2023-2029)11.5 Japan E-books Production, Revenue Forecast (2023-2029)11.6 South Korea E-books Production, Revenue Forecast (2023-2029) amazon.com

12 Consumption and Demand Forecast12.1 Global Forecasted Demand Analysis of E-books12.2 North America Forecasted Consumption of E-books by Country12.3 Europe Market Forecasted Consumption of E-books by Country12.4 Asia Pacific Market Forecasted Consumption of E-books by Region12.5 Latin America Forecasted Consumption of E-books by Country

13 Forecast by Type and by Application (2023-2029)13.1 Global Production, Revenue and Price Forecast by Type (2023-2029)13.1.1 Global Forecasted Production of E-books by Type (2023-2029)13.1.2 Global Forecasted Revenue of E-books by Type (2023-2029)13.1.3 Global Forecasted Price of E-books by Type (2023-2029)13.2 Global Forecasted Consumption of E-books by Application (2023-2029)13.2.1 Global Forecasted Production of E-books by Application (2023-2029)13.2.2 Global Forecasted Revenue of E-books by Application (2023-2029)13.2.3 Global Forecasted Price of E-books by Application (2023-2029)

14 Research Finding and Conclusion

15 Methodology and Data Source15.1 Methodology/Research Approach15.1.1 Research Programs/Design15.1.2 Market Size Estimation15.1.3 Market Breakdown and Data Triangulation15.2 Data Source15.2.1 Secondary Sources15.2.2 Primary Sources15.3 Author List15.4 Disclaimer

Purchase this report (Price 3900 USD for a single-user license) -https://www.precisionreports.co/purchase/16503897

About Us:

Precision Reports is the credible source for gaining the market reports that will provide you with the lead your business needs. At Precision Reports, our objective is providing a platform for many top-notch market research firms worldwide to publish their research reports, as well as helping the decision makers in finding most suitable market research solutions under one roof. Our aim is to provide the best solution that matches the exact customer requirements. This drives us to provide you with custom or syndicated research reports.

For More Related Reports Click Here : amazon.comClinical Lab Software Market Size 2023 Global Industry Investigation by Share, Trends, Growth Factors, Developments, Product Innovation and Forecast till 2028

Sauce Market Growth Opportunities 2023 To 2028 report containes Analysis of recent developments and innovations, New product launches, upcoming challenges, and technology landscape

Sensory Rooms Market Latest Research, Industry Analysis, Driver, Trends, Business Overview, Key Value, Demand and Forecast 2023-2028

Mixed Reality Technology Market Research report forecast 2023 To 2028, Latest Industry News, Top Company Analysis, Research Methodology

Regenerated Fiber Market : Share, Industry Size, Opportunities, Analysis and Forecast to 2028 with Top Countries Data

The Pipe Marking Tape Market Size 2023 to 2028 : Forecast Research Report, Segment, Deployment, Applications, and Industry Analysis with Top Countries Data

Blasting Services Market Size, Share, Growth, Revenue, Demand, Future opportunity, analysis and forecast till 2028

Human Capital Management (HCM) Market is booming in near Future 2023-2028

Online Freight Platform Market Opportunities, Demand and Forecasts 2023-2028 with Top Countries Data

Online Auction Market Size 2023-2028 Current Development, Sale, Revenue, Application, Production Cost, Revenue Region

Press Release Distributed by The Express Wire

To view the original version on The Express Wire visit E-books Market Size In 2023 : High Demand, Share, Top Countries Data, Industry Analysis by Top Players, and Forecasts to 2029

COMTEX_422517992/2598/2023-01-12T00:06:19

Is there a problem with this press release? Contact the source provider Comtex at editorial@comtex.com. You can also contact MarketWatch Customer Service via our Customer Center.

The MarketWatch News Department was not involved in the creation of this content.

Amazon: Underestimated By The Market

HJBC amazon.comv amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com

IntroductionShareholders of Amazon (NASDAQ:AMZN) stock have had a tough year so far. The stock is down close to 50% so far this year and seems to have lost all near-term upside momentum over the last couple of weeks. There have been a couple of serious hits for investors in Amazon this year with a massive drop after the first quarter results and another one after the third quarter results. Many people would say to you that these drops just offer new buying opportunities, and you should load up some more. As a shareholder of Amazon, I would be urged to say the same. Reading Seeking Alpha, you will come across many different opinions on Amazon. Just by looking at the last 10 articles published there are extremely bullish contributors with strong buy ratings and very bearish contributors with sell ratings (and everything in between). I don't think this should be surprising as Amazon is a difficult company to judge. With hundreds of billions in revenue, loss-making quarters, a high-growth cloud ecosystem, a struggling eCommerce business, and thriving subscription services, Amazon offers a wide offering of discussible items. So, what should you do with Amazon?

I am investing for the long-term and Amazon's incredible ecosystem, moat, and exposure to high-growth industries are to my liking. If you are a short-term trader, this article will not be for you. I believe Amazon has several growth drivers that make it a no-brainer investment for the long term. Yet, I believe it is hard to predict whether the current price weakness is a good buying moment as there seems to be more weakness ahead for the economy and Amazon. At the same time I feel like the long term prospects are being underestimated by both investors and analysts.

This is my initial thesis on Amazon. Let's get to it!

Amazon.com Inc.amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com

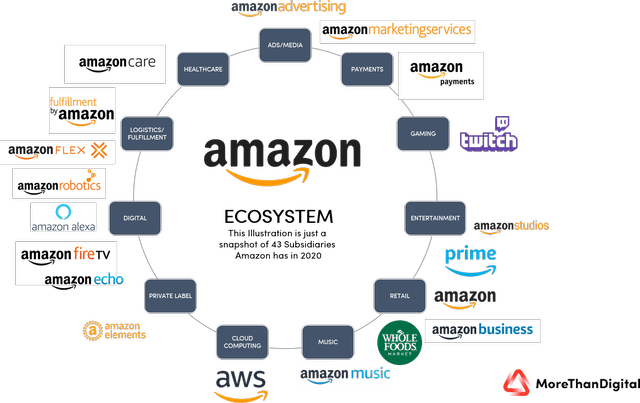

Besides being exposed to many different industries, it is also the biggest player in many of them. Amazon is the #1 eCommerce platform, smart speaker provider, cloud computing service (AWS), and live streaming service (Twitch). Amazon combines many of its popular services through a subscription plan, Amazon Prime.

One of the most popular parts of the subscription service is Prime Video, the video streaming service owned by Amazon. The company distributes a large number of entertainment forms through services such as Amazon Music, Twitch, and Audible. To fight the competition in the video streaming industry, Amazon created its own film studios through Amazon Studios with the highlight of the studio being the producer of the Lord of the Rings series.

Amazon ecosystem (MoreThanDigital) amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com

What is causing problems for Amazon?The latest earnings release has been analyzed enough by now, so instead I want to focus on what issues Amazon has been running into in order to define the halving of the share price YTD. In the introduction, I have already mentioned some of these problems.

The biggest one is the profitability problem. While Amazon managed to report sales growth of 15% over the latest quarter, operating margin and free cash flow did not follow this pattern. Where the operating income was $4.9 billion in 3Q21, this decreased to $2.5 billion over the latest quarter. The North America segment operating loss was $0.4 billion compared to $0.9 billion in profit in 3Q21. International saw an even bigger loss of $2.5 billion. This means these two segments lost a total of $3.4 billion. As most of this revenue comes from the eCommerce business these segments already operate with very low margins. With the impact of a sudden growth slowdown, extreme inflation, high fuel costs, and too many people working in distribution centers, Amazon's operating margin fell. All these factors are pressuring profitability for Amazon, but most of these seem to be temporary. Management is working on improving profitability and has stated that this should be the low point from a profitability standpoint. Still, Amazon has seen an incredible increase in operating expenses as a result of these headwinds which then resulted in negative cashflows. These do not immediately need to be a problem for Amazon as the company still has over $50 billion in cash on the balance sheet, but taking on more debt is not preferred.

AWS operating income was a positive $5.4 billion, which was an increase compared to the $4.9 billion of 3Q23. This kept Amazon's bottom line in the green. amazon.com amazon.com amazon.com amazon.com

When considering the very important free cash flow, there is not much room for positivity. Over the last 12 months, free cash flow was a negative $19.7 billion compared to a positive free cash flow of $2.6 billion in the 12 months before. amazon.com amazon.com amazon.com amazon.com

This all sounds very bad and I am not going to be able to tell you that it is not. Yet, these headwinds are temporary and should dissipate over time and bring up profitability again. In addition to this, I expect Amazon to become much more profitable in the future as business segments with higher growth than retail will become a larger part of revenue and drive up the operating margins.

Overall, current profitability and cash flows are worrying, but with these issues being temporary this should not be of any worry to long-term investors.

A second problem I would like to point out is the forecast given by management for 4Q22. Amazon guided for $140 to $148 billion in sales, meaning growth will slow down significantly to just 2% - 8%. Operating income is expected to be between $0 and $4 billion. This estimate was far below the consensus estimate of over $155 billion in sales. These are the reasons Amazon gave for the lower forecast:

Our results are inherently unpredictable and may be materially affected by many factors, such as uncertainty regarding the impacts of the COVID-19 pandemic, fluctuations in foreign exchange rates, changes in global economic and geopolitical conditions, and customer demand and spending (including the impact of recessionary fears), inflation, interest rates, regional labor market and global supply chain constraints, world events, the rate of growth of the Internet, online commerce, and cloud services, and the various factors detailed below. amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com

I feel like Amazon is being overly conservative with this forecast and with inflation easing over the last couple of months and the dollar losing some strength, this could lower the FX and inflationary impact on the results. In addition to this, consumer spending remains to be relatively strong which could cause a better than expected quarter. While the outlook might be bad, I think this opens up for a significant amount of upside and analyst revisions.

Three main growth driversBy looking through the near-term headwinds, we can see the amazing long-term potential for Amazon. Amazon is exposed to incredible growth trends and has a strong market position in many industries giving it a strong moat. I continue to see strong growth for Amazon going forward and eventually also margin expansion as other business segments with higher margins increase as a share of revenue.

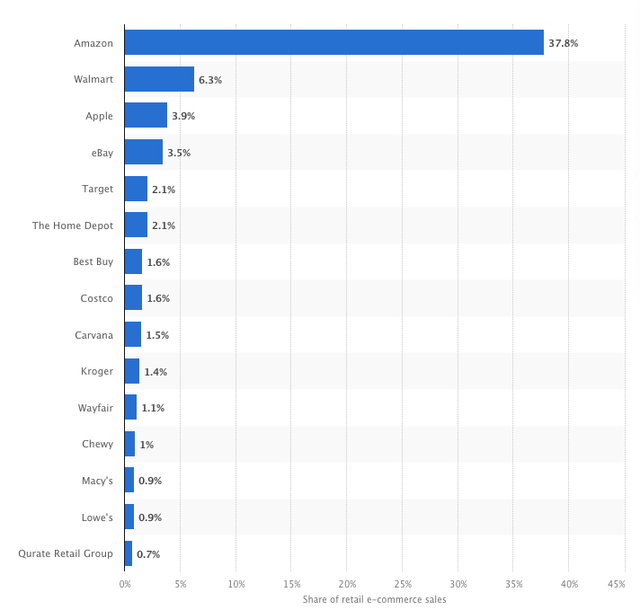

Amazon is in a great position to realize future growth through its eCommerce segment. Amazon has done several things really well in the past that will benefit them in the future. These include investments in its own delivery network and consumer retention by offering many services through its Prime subscription. Amazon has a market-leading 37.8% market share in retail eCommerce in the US as of June 2022. This gives Amazon an incredible moat. amazon.com amazon.com amazon.com amazon.com

Marketshare eCommerce in the US as of June 2022 (Statista) amazon.com amazon.com amazon.com amazon.com amazon.com

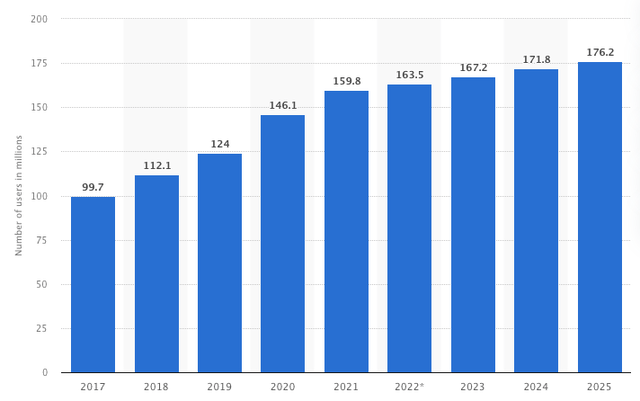

To keep its market share, Amazon can leverage delivery opportunities through its own delivery service (such as same-day delivery) and attract customers by offering attractive upside through its Amazon Prime subscription (such as discounts and other advantages). Amazon Prime offers multiple services such as same-day delivery, streaming through Prime Video, using Prime Music, and much more. Most of all, the subscription offers customers the opportunity to benefit from the best deals offered through Amazon. Amazon Prime subscribers now total more than 165 million. Amazon Prime subscriber numbers are expected to increase to over 176 million by 2025.

Amazon prime subscribers in millions (Statista) amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com

Amazon has been losing market share in the eCommerce market over the last few years with other large retailers such as Walmart (WMT) increasing their focus on the eCommerce market. Still, Amazon remains to be by far the largest eCommerce company and is in the #1 position to benefit from the growing eCommerce market as part of the digitalization trend. The eCommerce market is projected to be worth $904.9 billion today and will continue to grow rapidly to a massive market value of $1.7 trillion by 2027. Even if Amazon's market share would drop further to just 30%, this still equals over $500 billion.

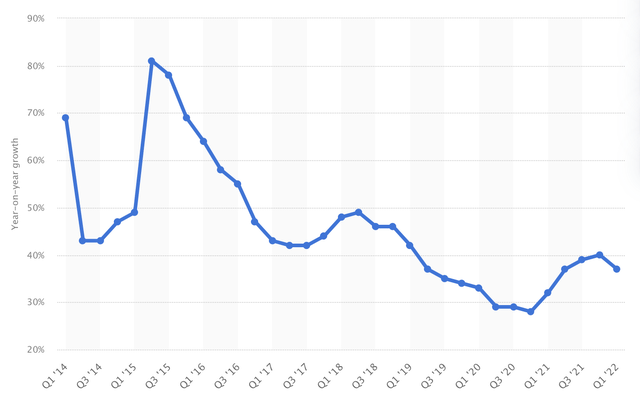

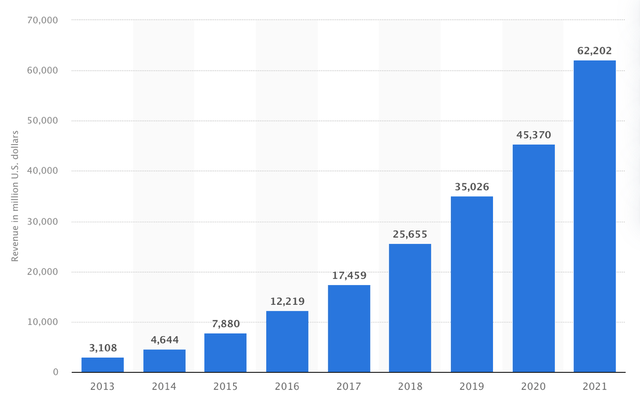

Secondly, AWS has been and increasingly is, the most important growth and profitability driver for Amazon. With AWS becoming a larger part of Amazon, this will have some serious advantages for Amazon's profitability. Even more, lots of contributors on Seeking Alpha have stated that they think that AWS by itself is worth the current market cap of Amazon with the segment generating $62 billion in revenue in FY21 and growing at close, or over, 30% while maintaining strong margins of around 30%. It is safe to say that based on operating income of 2021, AWS as a separate company could be worth around $740 billion (P/E of 40). amazon.com amazon.com amazon.com amazon.com amazon.com

AWS segment growth rate (Statista) amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com

AWS segment revenue (Statista) amazon.com amazon.com amazon.com amazon.com amazon.com

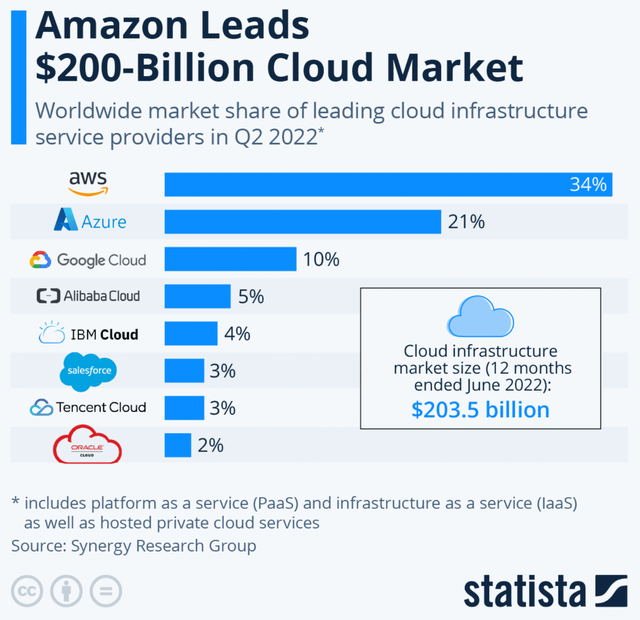

Driving growth for AWS going forward will be its strong market position in a growing industry. The shift towards the cloud is still strongly continuing and is not expected to slow. According to Fortune Business Insights, the global cloud computing market size is expected to grow at a 17.9% CAGR through to 2028. The total market size in 2028 will be $791.48 billion and therefore creating a massive opportunity for AWS. AWS is already the largest cloud platform across the globe with a 34% market share.

Statista amazon.com amazon.com amazon.com amazon.com amazon.com

AWS has had the first-mover advantage for a long time now, but Azure (MSFT) and Google Cloud (GOOG, GOOGL) are gaining market share. Azure is being a fierce competitor for AWS as the platform offers more possibilities to clients. I expect AWS' market share to drop slightly over the next couple of years to about 30%. Yet, a 30% market share in an $800 billion market is still offering massive growth potential.

In the end, AWS has a strong market share in one of the most promising industries. With the market expected to grow at close to a 20% CAGR, I believe AWS should be able to keep growing close to 20% until 2028. The recent slowdown seems worrying and looks to be an industry-wide trend with the same happening for Microsoft's Azure segment. Cloud growth might dip going into 2023 but will definitely rebound over the next couple of years. Eventually, growth in the AWS segment will drive both growth and profitability for Amazon as a whole.

The final growth driver for Amazon I want to point out right now is advertising. This is not something people relate with Amazon, but Amazon is one of the largest advertisers in the world. During the third quarter, Amazon reached $9.5 billion in advertising revenue, growing 25% YoY. This shows advertising growth is more resilient than industry-dominating companies like Meta and Google. Growth even increased compared to the previous quarter. So, what makes Amazon so attractive to advertisers? It is primarily the fact that Amazon does not need to track its customers - the customers simply tell Amazon what they want by typing this into the search bar on the Amazon website/app. Amazon then brings up other relevant products compared to your search as an advertisement. This makes Amazon very attractive to advertisers as the platform attracts way over 2 billion customers every month.

Amazon held a 14.6% market share in the digital advertising market as of late last year. This puts Amazon in a strong position to benefit from yet another strong growth trend. The digital advertising industry is expected to grow at a 13.9% CAGR until 2026 to reach a total market cap of close to $800 billion. Amazon still has great potential to gain market share on Meta and Google as the platform keeps growing and Amazon expands its advertising efforts into Prime Video - another huge advertising growth opportunity.

In addition to a strengthening market position and growing advertising market, this segment also holds very high margins as shown by Google and Meta. Therefore, I believe that a fast-growing advertising segment will be beneficial to Amazon's bottom line. Advertising will grow faster than Amazon as a whole and therefore become a larger part of total revenue. This will result in margin expansion for Amazon and advertising will be a strong driver of free cash flow as well.

I think we have established now that growth will not be the issue for Amazon, and I think it's fair to assume that Amazon will continue to grow by solid double digits over the next decade after a possible dip in 2023. Analysts' expectations are telling us the same story with growth in the low double digits until 2027 and no dip in 2023. I think Amazon will outperform its fourth-quarter expectations and those of analysts which will result in an upwards revision by analysts. I believe Amazon will grow closer to 15% until 2027. Bottom-line growth will be growing at a much faster clip as inflationary impacts disappear and investments drop as a percentage of revenue. Just as I explained above, the revenue mix will be another contributor to higher margins. Analysts project massive bottom-line growth from 2024 onwards as can be seen below.

EPS estimates (Seeking Alpha)

Valuation & Balance Sheet amazon.comFrom a valuation standpoint, Amazon is a tough one. Amazon is and has been, an expensive stock. Yet, this has never stopped it from generating massive returns in the past. If we look at the current valuation metrics Amazon receives a D- for valuation from Seeking Alpha. EV/sales now stands at 2.05 and is 40% below its 5-year average. Price/Sales is 1.85 and 44% below its 5-year average. From a historical standpoint, Amazon does not look as expensive as it has been. Of course, that does not make it cheap, but considering both top and bottom-line growth prospects it is not that expensive. Fellow contributor Ben Alaimo wrote and calculated in his recent article on Amazon a fair value price of $184 which would make the stock undervalued by over 50%.

amazon.com amazon.com amazon.com amazon.com amazon.comAmazon's balance sheet is also not the prettiest. The company does have a strong cash position of $56.8 billion, but the debt pile is massive at $164 billion. Considering Amazon has not been able to generate decent free cash flow lately, this is a bit of a worrying sight. The cash position has come down in recent years and the debt has been trending in the opposite position (increasing significantly). The large amount of cash does allow Amazon to continue investing in the business without taking on much more debt.

Risks & ConclusionWhile I have just laid out the largest growth drivers and believe the company has great long-term growth potential, the stock is not without any risks. The main risk to Amazon at the moment remains to be the economy combined with inflation and rate hikes. As Amazon is highly exposed to consumer spending on its eCommerce platform, a potential recession poses a serious risk. So far unemployment is not becoming a problem yet and let's hope it won't at all, but there is a significant chance that unemployment will rise in 2023 when we end up in a recession. This will then have a significant impact on consumer spending and growth potential for Amazon. In addition, there is already a slowdown visible within the cloud computing industry as businesses are postponing IT spending. With continued high inflation and less sales growth, the bottom line for Amazon will not be getting better in the near term. And that is exactly the problem for now. The near-term impact of economic worries is highly unpredictable, and no recession is the same as the one before. I, therefore, find it hard to decide whether you should buy Amazon right now or wait out further downturns. One positive signal are the latest reports on inflation coming down, so this should help Amazon as fuel costs also trend lower.

I do know that from a long-term growth perspective this company is a no-brainer to me, and I see great growth ahead. Whether this is the bottom is not a question I can answer right now, but I do feel like a lot has been priced into the stock already, resulting in a significant drop so far this year. To me, Amazon is a strong buy at prices below $100 per share as I feel like downside risk is limited. I do recommend buying in small bits as there could very well be better entry prices coming.

Long-term, the main focus will be on whether Amazon can significantly improve profitability and free cash flow. Amazon has the levers to increase profitability, but it needs to use them as well.

For now, I rate the stock a Strong buy as I see a strong outperformance for Amazon over the final quarter of the year driven by better economic data, a falling dollar, and low expectations by management. Amazon is close to its yearly low and I feel like reactions have been overdone. For me, a lot will depend on its 4Q22 earnings as these will dictate where the stock will go over the next year.

I rate the stock a Strong buy as I feel like Amazon has strong long-term tailwinds thanks to its exposure to high-growth industries such as cloud computing and advertising. Yet, I do believe there is still a significant risk of more weakness over the next 6 months as we get a better idea of where the economy is headed.

Inside Amazon’s global worker movement

This article is part of a special report, The Essential Tech Worker.

LILLE, France — When Amazon workers installed a mock guillotine in front of Jeff Bezos' home in Washington D.C. last summer, they gave the world's richest man a chilling show of anger.

But the real challenge to Amazon management isn't from publicity stunts. It's coming from a new, digitized, international labor movement that is borrowing from the e-commerce giant's own playbook to press for higher pay and better working conditions around the world.

Known as the Amazon Workers International, the informal network of mostly warehouse workers brings together dozens of worker groups from the United States and six EU countries. With hundreds of participants, it is growing fast. Instead of gathering in person or joining picket lines, the AWI's key organizers do most of their work in videoconference sessions where "comrades" from multiple countries Zoom in to plot strategy on how to press their demands to Amazon management.

"Can you hear me?" Polish warehouse worker Agnieszka Mróz said late last month as she connected from her hometown of Poznań with French and Italian colleagues gathered a thousand kilometers away, at the office of French union Sud Solidaires in an old railway factory in Lille, northern France. Other workers from Poland, Germany and the United States had also joined the call, AWI's annual gathering, to discuss Amazon's response to the pandemic and upcoming actions.

The network's online-first approach — and the emphasis on international coordination — underscores a lesson that these workers have absorbed over the last decade: They have little chance of winning concessions from management if they pitch demands locally, via traditional union methods.

Amazon is just too big, too agile and too powerful. With more than 175 warehouses, or "fulfillment centers," dotted around the world, hyper-optimized management methods and a market capitalization close to $1 trillion, the company epitomizes the might of the U.S. technology sector and has, as a rule, declined to recognize or actively engage with trade unions.

Even during a pandemic that forced thousands of warehouse workers to brave the risk of infection, inflaming tensions with management at several sites, Amazon hasn't changed its basic stance toward labor groups, arguing that its hourly rates are at the top end of what the industry offers. When workers went on strike in France in May, the company temporarily shut down its warehouses in the whole country, re-routing orders via Italy.

Meanwhile, the company doubled its year-on-year profits in the second quarter to $5.2 billion and went on a hiring spree to keep up with demand for shopping extravaganzas such as Prime Day (a chance to grab products at lower prices), Black Friday and Christmas. Bezos personally made over $87 billion this year, according to the Bloomberg Billionaires Index. amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com

That's where AWI aims to make a difference. By coordinating demands for wage increases, additional breaks or new safety measures internationally, it wants to force the company into changes for the warehouse workers on whom it depends to deliver the goods.

“Amazon and most big companies that control our lives are international,” said a worker at a delivery station in New York City who asked to stay anonymous out of concern the firm might retaliate against him. "If we want to have a sustainable future with a habitable earth, then it’s going to take an international movement."

There are signs AWI's work is having an effect. While it's difficult to match causes and effects, Amazon has, under increased pressure from labor groups, introduced 150 so-called "process changes," like staggered breaks and shifts, since March to reduce COVID-19 risks in its warehouses. At the height of the pandemic, the company also introduced a temporary €2-an-hour hazard pay bonus, as well as one-off bonuses.

“We’ve already spent more than $800 million on COVID-19 safety measures, with investments in personal protective equipment, enhanced cleaning of our facilities and, of course, social distancing,” an Amazon spokesperson said.

But the workers are looking for more. “The pandemic showed who are the important people in society. Workers have the self-esteem to make demands. Before nobody would have demanded €2 more,” said Christian Krähling, a German worker from the town of Bad Hersfeld.

Don't call it a unionAWI got started in 2015, when workers in the German city of Bad Hersfeld went on strike. Amazon workers in neighboring Poland — where the company has set up fulfillment centers to serve the German market, but not the Polish one — took notice bec amazon.com amazon.com amazon.com amazon.com amazon.com amazon.comause a strike at a German warehouse meant more work for them.

“The first idea that we need to do something came from the feeling that the conditions were much worse in Poland than in Germany or England," said Mróz, one of the founding members of Amazon Workers International.

The Polish group decided that the only way to respond to the situation would be to start coordinating with colleagues in Germany. A group drove for seven hours from Poland to meet them in Bad Hersfeld, marking the start of what they called the Amazon Workers International — a name that they insist has nothing to do with a traditional trade union.

While many workers belong to local unions, they stress that AWI is not a union nor is it affiliated with one.

“The unions are old, and they are not used to grassroots stuff. Our goal is not to do this for unions. We do it to get power to the workers. We see the union as an instrument to get that,” said Krähling.

Above all, AWI wants to empower warehouse workers by demonstrating that demands in one place are supported much more broadly.

In the United States, for example, a petition from workers demanding better health and safety measures and hazard pay was bolstered by over a thousand signatures from Poland.

When workers in Germany were successful in blocking software that is meant to keep watch over how employees are following social distancing rules, they shared their experience with other groups so they could borrow their methods.

When Amazon's France-based workers went on strike, prompting a court case that led to the company closing its warehouses in the country, Polish workers paid close attention. Ultimately, they tried to use the same EU directive that was invoked in the French case to argue for stronger worker representation in Poland.

Polish workers produced leaflets to highlight that workers have the right to leave the warehouse whenever they don’t feel safe.

“It’s a direct example of how we got a new tool from the French experience,” Mróz said.

Judith Krivine, a lawyer representing the French union Sud Solidaire, said international cooperation was crucial to successful operations. “It’s really important that they talk together and give ideas to each other and fight together for better conditions. If not, there will always be social dumping,” Krivine said.

Hello world amazon.comDespite the early momentum, AWI has a lot of growing to do. The network recently elected a committee with central coordinating figures, and now plans to reach out to workers in Asia, Latin America and new locations in Europe to broaden its reach.

amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.comIt helps that workers all share a common language: Amazonspeak. “All Amazon workers know the same corporate slang," Mróz said. "It’s easy to find the common language, to build solidarity and trust and start working together.”

Although there is power in numbers, the movement still has to convince its employer it is a force to be reckoned with. “Amazon won’t talk to us because they don’t want to give us legitimacy,” Krähling said. "They never use the word ‘Amazon Workers International’. They say we are an external organization trying to make a profit off of Amazon’s success."

Krähling said AWI operates on a voluntary basis, and activists pay for their annual meetings themselves. It is hard to pinpoint how many workers are part of the network, as staff turnover is high and participation in campaigns can be unpredictable, but the network’s meetings before the pandemic attracted some 50 organizers from around the world.

“We want to be seen as organized as a collective force which is not outside the organization,” said Mróz.

When asked about the group and whether the company would consider talking with such a network, a spokesperson for the company said it already has works councils and employee bodies.

“We encourage anyone to compare our overall pay, benefits and workplace environment to other retailers and major employers in the communities we operate in. For us, it will always be about providing a great employment experience through a direct connection with our employees and working together as a team to provide a world-class customer experience,” the spokesperson said.

But workers say conditions could be better. And they feel like the company’s coronavirus safety measures — particularly around social distancing — give Amazon a convenient excuse to keep workers far from each other in case they get any ideas about organizing.

Krähling describes the canteen in his warehouse as a plexiglass prison. “All these measures that were taken during the corona crisis — it's like a dream come true,” he said.

Despite the rising tensions, the workers in the network say they're only getting started.

“If we didn’t have this struggle, I probably would have left the company,” Krähling said.

"Yes, OK, it’s stressful, you have a lot of problems, it’s a lot of struggling," he added. "But on the other hand, I never had a workplace where I met so many friends. It’s a lot of fun."

AMAZON.COM amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com amazon.com

Comments

Post a Comment

If you have any doubt, please let me know....