HOW TO CREATE AN AFFORDABLE ONLINE MARKETPLACE WITHIN HOURS WITH PROGRAMMING AND CODING ON BLOGGER....

- Get link

- X

- Other Apps

01

DefinedCrowd Launches DefinedData, an Online Marketplace of AI Datasets Available for On-Demand Purchase

High-quality data is now just a click away..............https://gumroad.com/a/

SEATTLE, July 7, 2020 /PRNewswire/ -- DefinedCrowd, the leading data provider for Artificial Intelligence, today announced the launch of DefinedData, a new offering that enables customers to rapidly accelerate their AI-initiatives into the market by acquiring pre-collected, annotated, and validated AI training data from an online catalog.....https://gumroad.com/a/

This product launch follows the recent closing of a US $50.5M Series B funding round and the addition of new investor Balderton Capital. This funding round enables DefinedCrowd to continue its launch of new and innovative data solutions for the AI industry.

"Machine learning teams building AI models have always faced one particularly pressing problem, and that is continuous access to highly accurate data. When technology-focused companies want to launch their AI initiatives into the market quickly, they simply don't have the time to collect and validate the data required to do so," said Daniela Braga, founder and CEO of DefinedCrowd.

According to Braga, DefinedData aims to solve this problem by providing time-strapped customers with high-quality, pre-collected datasets, already annotated and validated by a global crowd of over 300,000 contributors. Usually, creating such high-quality datasets would take a machine learning (ML) team anywhere from three to six months. However, DefinedData makes accessing high-quality data for AI much easier.

Customers can simply browse pre-collected AI datasets in multiple languages, domains, https://gumroad.com/a/

"As the appetite for high-quality data continues to grow, the market for training data will become increasingly modularised. Training data repositories and marketplaces will be a key feature of the value chain, allowing teams to both monetise existing data sets as well as source new data time and cost-effectively. We are incredibly excited to be joining Daniela and her team on their journey as they pave the way in this space," said Laura Connell, Principal at Balderton Capital.

DefinedData will maintain the commitment to quality for which DefinedCrowd has become known. To ensure the highest levels of accuracy and authenticity, multiple key performance indicators (KPIs) will be used including Word Error Rate, gender distribution levels, age distribution, ambient noise levels, nativeness (accuracy of native speakers), and domain accuracy.

"Whether you're building a prototype or minimum viable product, testing internal models or benchmarking third-party cognitive services, our continually updated library of datasets will help you quickly achieve your AI goals," concluded Braga.

To learn more about DefinedData, visit the catalog here...........https://gumroad.com/a/

Contact

Catarina Peyroteo SalteiroDirector of Global Communication & Brand pr@definedcrowd.com

Related Images

definedcrowd-logo.pngDefinedCrowd logo

View original content to download multimedia:http://www.prnewswire.com/news-releases/definedcrowd-launches-defineddata-an-online-marketplace-of-ai-datasets-available-for-on-demand-purchase-301089305.html

SOURCE DefinedCrowd Corp.

02

Marketplaces in the financial industry - Here to stay?

Marketplaces are hip and trendy on the internet and will likely evolve even more in the near future. In some markets (like food delivery, transportation, commerce, holiday…) they already represent double digit market shares (e.g. in 2018 $1.86 trillion was spent globally on the top 100 online marketplaces), but for the financial services sector, their impact (even though there are a few unicorn FinTechs in this space) on the industry is still limited.

Any form of intermediation (travel agents, taxi dispatchers…) ..........https://gumroad.com/a/

Furthermore, marketplaces are strongly intertwined with other concepts like the gig-economy, the sharing-economy and the API-economy. All these trends will ultimately lead to

More flexible, short term jobs (gig-economy), e.g. all Uber taxi drivers are independent

People owning less assets:

Share assets in a user-friendly and controlled way or

"Everything as a Service" (e.g. Amazon Prime, Uber Eat subscription…)

Outsourcing all day-to-day household jobs (cleaning, cooking, driving, shopping, groceries…)

A limited set of distribution access points on the internet selling items and services from different "Product Factories" (e.g. a very big part of Amazon’s revenues is already made from 3rd party vendors selling their products on the Amazon platform)

All this will impact the financial services sector even more. Especially the rise of Open Banking APIs (currently only in cash accounts and payments space via PSD2, but likely also for other domains in the future) will allow to create marketplaces on top of the financial industry, instead of the current marketplaces, which aim to create a sort of financial system next to the existing one.

But before going into more details about the characteristics and trends of digital marketplaces, it’s probably a good idea to first define, what we understand under the term "digital marketplace" (as this buzz-word has become so overloaded, that there is no unique definition anymore). For me, a "digital marketplace"......https://gumroad.com/a/

A platform, i.e. a stand-alone software solution, which is open for users to onboard independent from other software solutions

Multi-tenant, i.e. multiple parties can work together on the same application instance, while still respecting certain security/privacy rules, so that not all data is available to anyone

A place which brings together multiple parties with different needs(parties which offer something and parties which search something):

Minimum 2 party types (consumer & producers) - but more is possible (e.g. broker/intermediary/…)

For each party type there are minimum 2 actors (but usually more).

The most important part in this definition is the fact that it groups X consumers with Y producers. This is where a marketplace deviates from most SaaS software solutions and corporate websites (e.g. internet banking solution of a bank), as typically you only have 1 producer on those platforms.

This double-sided nature of a marketplace gives some interesting dynamics. Where a typical company only needs to grow out its customer base, a marketplace needs to grow out both sides and preferably keep them balanced (otherwise 1 side will be disatisfied and leave the marketplace, after which the other side automatically will leave as well). This means a marketplace typically struggles with a "Chicken and Egg" problem in the beginning, but once passed this point, a marketplace can scale exponentially thanks to its enormous scale/network effects (i.e. not burdened by constraints of conventional transactional businesses like inventory supply and balance sheet). Furthermore, once a marketplace is established, it is enormously sticky and tends to grow to a monopoly.

Other dynamics of a marketplace are:

High initial cost (lot of initial capital required) for implementing the platform and getting the critical mass (i.e. high customer acquisition cost)

Once operational and critical mass is achieved, very limited capital cost, as inventory is brought by the (external) suppliers

Hard to control quality, as quality is not directly under the control of the marketplace, https://gumroad.com/a/

but rather distributed to the different parties acting on the marketplace

Hard to avoid that producers and consumers don’t match on the marketplace, but execute outside the marketplace (to avoid any commission linked to the marketplace)

Marketplaces need to establish trust between producers and consumers (parties which didn’t interact directly before onboarding on the marketplace). This can be obtained via several mechanisms, like a due diligence during the onboarding process, party rating, reviews, asking collaterals, marketplace providing guarantees and/or insurances…

Marketplaces need to provide autonomous value. This means providing value-added services that benefit producers and consumers beyond the transaction.

Given these dynamics, it is safe to say, that financial service incumbents(banks and insurers) are ideally positioned to build out marketplaces:

Banks & insurers have cheap access to capital, required to back the high initial cost of a new marketplace, https://gumroad.com/a/

Banks & insurers have a strong brand, which is required to promote a marketplace

Banks & insurers have strong trust reputation, providing the necessary trust for consumers and producers to transact

Banks & insurers already have a large customer base, allowing to jump-start the platform directly with a critical mass

Banks & insurers can profit from a lot of cross-selling opportunitiesfor financial products/services

Banks & Insurers have already (multi-lingual) large customer contact centers, which can be used to operate the platform

Most products and services linked to the financial services industry are high-value, high-frequency transactions, which is the sweet spot for a marketplace.

The biggest hurdle for the incumbents is however their low agility and low delivery speed. This can be tackled by creating a dedicated team, which has the mandate to be autonomous and flexible (i.e. create a FinTech within the bank/insurer). While it is difficult to create such autonomous teams for the typical projects within a bank/insurer, it is much easier when setting up a new marketplace, thanks to its isolation from the rest of the application architecture. This separation of the existing architecture and processes gives the additional advantage that the marketplace can be easily spinned-off in a later phase, which is a necessity for ensuring the independence of the marketplace and thus the further expansion of the marketplace.

Of course, everything will start with a good idea for a new marketplace in the financial services industry.Different techniques can be used to find this good idea:

Top-down: brainstorming for new ideas of marketplaces. Once ideas are found, evaluate them on their market potential.

Bottom-up: build up ideas by searching for markets which meet the target requirements of a successful marketplace or by combining different classification axes for marketplaces (see below).

In both scenarios, we use 2 tools:

Evaluating the business potential of a marketplace

Classifying a marketplace according to its characteristics (allowing to easily map to comparable marketplaces, so that ideas and components from those similar marketplaces can be harvested)

The evaluation of the business potential is done via 5 axes:

Fragmentation of the market: does the market have a lot of small players (i.e. a variety of producers and consumers) or is the market already consolidated to a few large players. The more fragmented the market, the more potential for a successful marketplace.

Transparency of the market: is the market transparent, i.e. easy to compare offers of different producers, are prices publicly available, is it easy to understand how pricing calculations are done… The more intransparent a market is, the more potential for a successful marketplace.

Market size: is there a large market and is this market still growing or already consolidated. Small markets, which are not expected to grow soon, are to be avoided. However, markets which are small now, might be small due to the lack of a digital marketplace.

Monetization potential: how easy is it to ask a commission or fee for the service offered by the marketplace and if so, what is the frequency a user will transaction and what is the amount for which he will typically transact. High-frequency, high-value marketplaces are ideal, but as long as 1 of the 2 criteria (i.e. transaction frequency and amount) is "high" a marketplace can be successful. E.g. Uber is a high-frequency, low-value marketplace, https://gumroad.com/a/

but is definitely successful.

Existing competition: are there already good digital marketplaces or equivalent offers in the market? Evidently a flooded market should be avoided as well.

The classification of a financial services marketplace can be done via multiple axes:

Type of intermediated item

Type of consumer (= investor)

Bank

Corporate

(Physical) Person

Type of producer (= issuer/supplier)

Bank

Corporate

(Physical) Person

Number of parties actively involved in the transaction (i.e. taking an active decision via a non-automated manual activity)

Supply limitations

Method for transaction handling

Double-commit: both producer and consumer need to manually agree on conditions to transact. Typical example is a job offer marketplace.

Buyer-pick: producer enters his offer (with availability) and consumer can transact directly on the offer (e.g. Airbnb)

Supplier-pick: consumer posts a request and supplier claims it (e.g. Uber)

Taking the example of P2P lending for Retail customers (i.e. a physical person can lend directly money to another physical person facilitated via the platform), https://gumroad.com/a/

Business potential

Fragmentation: medium to high fragmentation, with a lot of players in the lending market (i.e. credit agencies, banks…)

Transparency: market is already quite transparent, i.e. prices are quite similar for different institutions and are publicly available on the internet. Furthermore price visualization is often standardized (e.g. via SECCI in European Union).

Market size: the loan market is still growing, but only with a few percent a year. The P2P loan market can however still grow exponentially by cannibalizing the existing credit market, as customers search for higher returns for investments and lower interest rates for financing.

Monetization potential: a commission on a sold loan can be easily requested. Furthermore, situated here in a "low frequency, high value" space, the monetization is guaranteed.

Existing competition: competition is fierce, as dozens of P2P lending platforms have flooded the market in recent year. E.g. in the peer-to-peer lending space in the UK alone there are over 100 different platforms. Furthermore, incumbent banks are digitalizing their credit origination processes more and more, making the existing financing options also more efficient and user friendly.

Classification

Type of intermediated item = Money

Type of consumer = Physical Person

Type of producer = Physical Person

Number of parties actively involved in the transaction = Two (Producer/Consumer)

Supply limitations = Supply is limited (only customers wanting to lend money)

Method for transaction handling = Buyer-pick (investor can subscribe directly to a loan posted on the platform)

As this article aims to demonstrate, the potential for digital marketplaces is enormous, but an initiative in this space is not just another implementation project. A marketplace, https://gumroad.com/a/

Check out all my blogs on https://bankloch.blogspot.com/

03

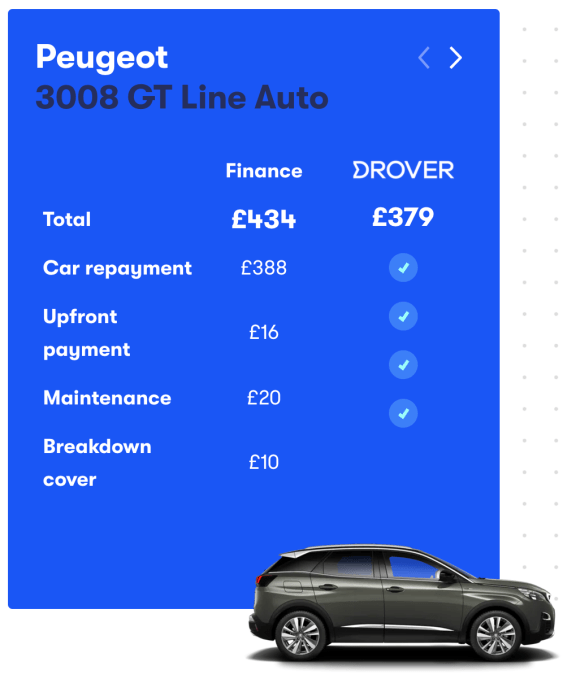

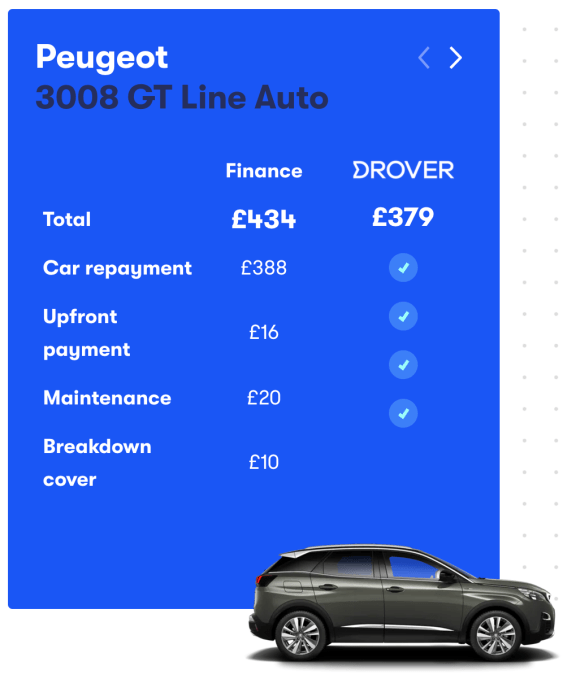

For better or worse, all of that brings us back to private cars, and the opportunity to play around with different ways of providing these to individuals, opening the door to companies like Drover to tap those who may have started to part with the idea of owning a car outright, but have yet to let go of the idea of using a private car altogether.

For better or worse, all of that brings us back to private cars, and the opportunity to play around with different ways of providing these to individuals, opening the door to companies like Drover to tap those who may have started to part with the idea of owning a car outright, but have yet to let go of the idea of using a private car altogether.

UK’s Drover raises $26M to take its car subscription marketplace to Europe

The future of transportation is in flux, and that continues to provide opportunities for tech companies to build solutions to provide new ways for us to get from A to B. In the latest development, https://gumroad.com/a/

The company has picked up £20.5 million ($25.7 million) in a round of funding co-led by three firms: Target Global, RTP Global (the Russian company formerly known as ru-Net) and Autotech Ventures. New investors Channel 4 Ventures and Rider Global, as well as previous backers Cherry Ventures, BP Ventures, Partech, Version One and Forward Partners also participated. Drover is not disclosing its valuation, and it has raised £27.5 million to date.

The plan, CEO and founder Felix Leuschner said in an interview, is to use the money to continue investing in the technology it uses to calibrate prices and personalise offers for individuals, as well as to hire more talent and gear up for more expansion. Founded in the U.K., Drover opened in France earlier this year, but in theory, wherever cars are sold and used is game. Drover’s growth to date seems to point to it being a strong candidate for driving ahead to new frontiers.

That’s because despite the huge drop in the economy in the last several months because of COVID-19, perhaps because of its flexible model — fitting for when you don’t know what is coming around the corner — Drover has seen business go up.

“May and June have been our best two months on record for us since launching three years ago,” said Leuschner, who added that it is continuing to see an acceleration in the business, doubling in revenues year on year. “Every month should be the best month when you’re a growing startup, https://gumroad.com/a/

Car ownership is going through a critical phase at the moment.

It was not that long ago when many people believed that the Ubers of the world, combined with other innovations in transportation like autonomous driving, improved public and communal transport models, on-demand rentals and new vehicles like electric bikes and scooters, would all combine to make it easier for individuals to forego traditional private car ownership altogether — the idea being that collectively, they would provide an economical, convenient and eco-friendly enough mix to make buying and maintaining a car obsolete.

That idea might still have some mileage longer term (excuse the pun!), but current events have thrown it for a loop: the COVID-19 pandemic has meant that people are staying at home a lot more, and when they do go out, many are proactively eschewing transportation forms that involve sharing space or touching surfaces that others have touched.

“We think this will lead to a renaissance for cars,” Leuschner said — a fact echoed by its investors.

“Drover offers an attractive and affordable alternative to car ownership, which has proven to be extremely robust during the recent COVID-19 crisis with record high subscriber bookings,” said Anton Inshutin, partner at RTP Global, in a statement. “We fully share in Felix’s vision for Drover as the future European leader in the car-as-a-service market, and offered our support to the company in both Series A and Series B financings.”

But even without a global health pandemic, https://gumroad.com/a/

For better or worse, all of that brings us back to private cars, and the opportunity to play around with different ways of providing these to individuals, opening the door to companies like Drover to tap those who may have started to part with the idea of owning a car outright, but have yet to let go of the idea of using a private car altogether.

For better or worse, all of that brings us back to private cars, and the opportunity to play around with different ways of providing these to individuals, opening the door to companies like Drover to tap those who may have started to part with the idea of owning a car outright, but have yet to let go of the idea of using a private car altogether.

Target demographics, Leuschner said, are people in their 20s and 30s who have some disposable income for a car and are more likely to be keen to pay the premium on incremental ownership to forego total cost of ownership, if it proves to be cheaper than leasing for the one-month minimum of usage on Drover (which appears to be Drover’s main competitor).

Others have attempted to tackle the subscription car market before, also focusing on customers that want to have the use of cars for more than just an hour or a day or even a week but don’t want to pay out to own them outright or get locked into long leases.

One of those — Fair in the U.S. — looked to be especially promising with big-name founders raising hundreds of millions of dollars in equity and debt from companies, including SoftBank. But it ultimately faced a spectacular implosion, unable to get the business model right.

Leuschner contends that while Drover might sound like the same model as Fair, it’s actually a very different vehicle on the inside. For starters, some two-thirds of its inventory is sourced from dealerships, OEMs and others that distribute cars.

They use Drover as another channel, https://gumroad.com/a/

“It’s an optimisation game for us,” said Leuschner. “When you have open inventory you get a better margin but more risk. We are at that point where we know what the best vehicles are for our customer base and we have a lot of data and trading history. We’re comfortable taking some risk and higher margin structure in those cases.”

Another key difference is that Drover is also only focusing squarely on private individuals, rather than working on subscriptions for professional drivers. That has meant that the drop off in business from those users, which some car leasing companies have seen as a knock-on effect from the fall in demand on ridesharing platforms, hasn’t had an impact for Drover.

It’s nonetheless a big market, https://gumroad.com/a/

“By tapping into ongoing digitalisation , https://gumroad.com/a/

Daniel Hoffer, managing director at Autotech Ventures, added in his own statement: “After studying the European landscape closely, we believe that Drover’s unique focus on a next-generation customer experience enabled by an asset-light approach has the potential to revolutionize how Europeans relate to car ownership. Bolstered by strong execution, Drover is poised to emerge stronger as a result of COVID-19 and recession-driven changes to consumer preferences in the ground transportation domain.”

Comments

Post a Comment

If you have any doubt, please let me know....